Nothing spreads like fear

An ALL CAPS financial crisis, pitchforked mobs roam Twitter, amateur economics unsurprisingly falls short, contagion fears rise, airlines continue to do airline stuff

Hi there!

The big news this week is…bank runs.

You know, some weeks nothing really happens. And then one week something so huge happens that it can feel like a month’s worth of news arrives in 24hrs at 100KPH.

On Wednesday, Silicon Valley Bank (SVB) announced they were selling some $2.25B USD of shares (NASDAQ SIVB) to firm up their balance sheet. Nothing critical to operations. The sort of thing, it now turns out, many banks are doing in high inflationary, volatile markets. Higher interest rates had created a $1.8B USD hole in their accounts, and they were going to sell some shares to make up that money. They communicated it to the markets in a (by any standards) pretty bad press release that overly highlighted that “SVB sold approximately $21B USD of securities, which will result in an after tax loss of approximately $1.8B USD in the first quarter of 2023.” Venture Capital firms (specifically Founders Fund) looked at this $1.8B black hole and began advising their portfolio companies that SVB looked unstable - and to pull their money. By Thursday morning, when SVB’s shares hit the opening bell of the NASDAQ, they immediately began to spiral, loosing 60% of their total value. SVB responded mid-run by telling everyone via Zoom to ‘stay calm’. By this point we’d entered an ALL CAPS, Mad Max predicting, emotionally spiralling, Twitter / WhatsApp group hype-cycle of doom.

Inevitably, the shares did not make it to Friday morning trading - in the NASDAQ pre-trading before the morning bell, the federal government (specifically the FDIC) stepped in and took control of the bank.

SVB was the 16th largest bank in the US - and they ended up with a negative cash balance of $958M USD having experienced a withdrawal of $42B USD in deposits by customers in a one day period. They had branches globally - specifically in Canada and the UK - which were also seized by their respective governments.

Global banking then got hit by the after shocks - S&P bank stocks alone shedding 6% of their value in the first day of trade. But there were other bank runs playing out, cascading silently amongst the chaos. Silvergate, the most influential bank in cryptocurrency, failed - already struggling off the back of last years FTX collapse, the SVB panic pushed them into default. Signature Bank, known for real estate investments in NYC, and who were increasingly moving into in crypto, also collapsed. The final gasps of consumer-focused cryptocurrency legitimacy lay in tatters somewhere on a trading room floor.

SVB, Silvergate and Signature are now all under FDIC control, with the US Government now acting as guarantor.

Now, you can be cynical. You can say - ‘hey, these are banks obsessed with startups and / or risk / venture capital / magic beans / digital pictures of monkeys - and they got what they deserved’. And with Silvergate and Signature, you might be right - it was a risky game they were playing. But SVB has been part of the fabric of modern business since 1983 - whether you realize it or not. Overnight, payroll firms seized. Benefits stalled. Popular Small Business tools were facing bankruptcy. The amount of modern technology in Small Business is staggering - from the servers that hold the data we all use daily, to the machinations of modern payroll, to the debt which keeps the lights on for that note taking app you like. And SVB was integral to funding all of that technology.

Unlike Main Street banks, SVB knew how to work with risk, and because of that they attracted early stage businesses who lacked cashflow. SVB would work with founders to fund their growth - often based simply on their belief in the founders abilities and the input of their sizeable business advisory network. And while you might read this and find the concept of ‘founders’ obnoxious, it’s not just the elite San Francisco 1% that SVB worked with - it was everyday Small Business owners too.

So what the hell happened? The issue for SVB was the bulk of their customer base. Venture Capitalists and Startup Founders loved SVB. But Venture Capitalists and Startup Founders are a jumpy, insecure bunch - so they often spend far too much time trying to be cool by stating bold opinions on Twitter about things they don’t totally understand. ‘Hot take’ tweets became rumours, rumours became panic, and given the real-time nature of social media - combined with the instant deposits that power modern banking - people started pulling their cash out of their accounts in a blind panic. Once the herd had moved, there was no stopping their momentum - and we had on our hands the worlds first social media bank run. The reality is, SVB was killed by its own fan base - if Twitter had experienced an outage on Thursday, SVB would likely still be alive and well.

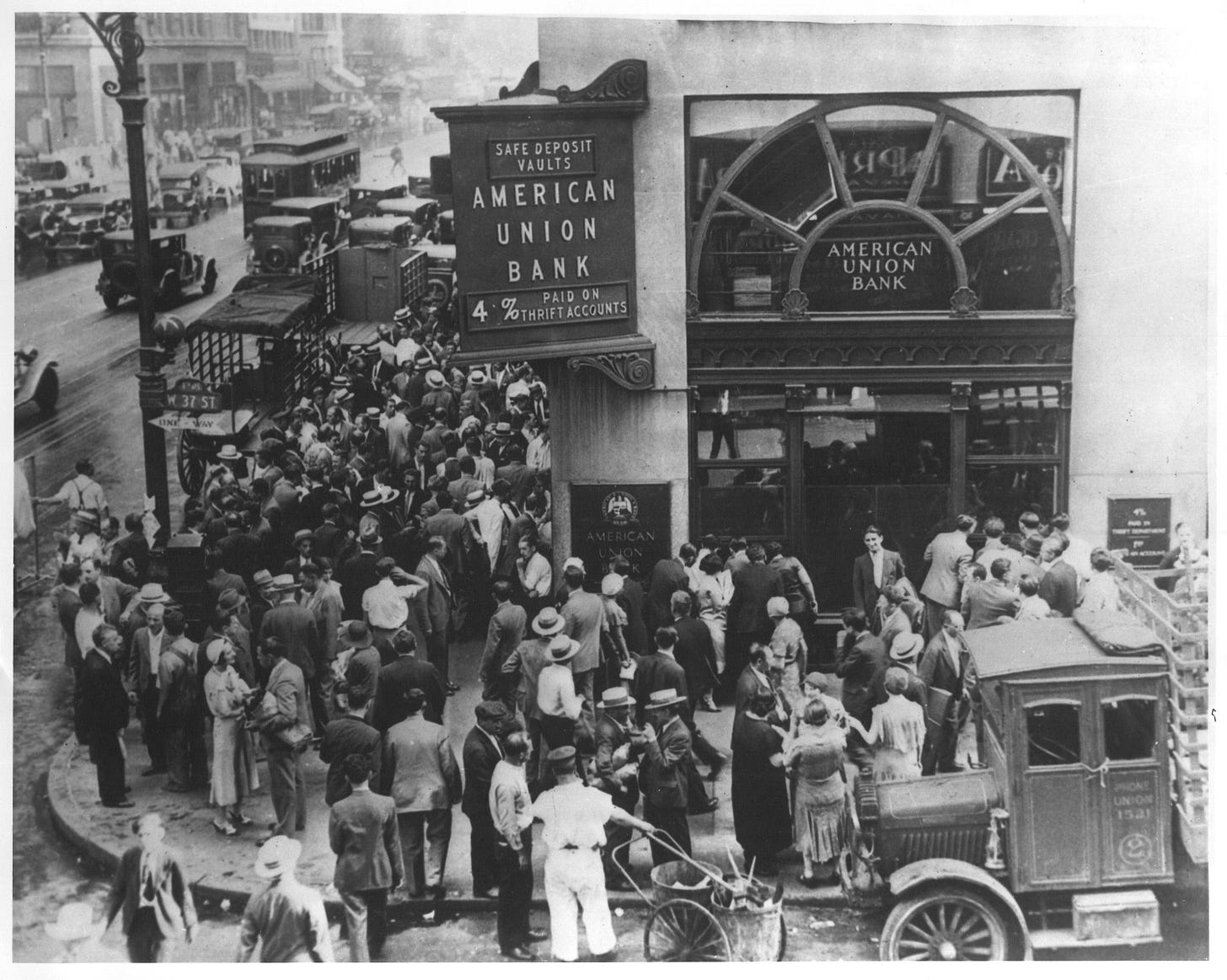

During the Global Financial Crisis there was no social media, and bank withdrawals meant turning up at the branch and asking for a cheque. When Northern Rock, the UK bank, witnessed a run in 2007, people queued around the block for days to access their cash. To stop the run, all you had to do was close the doors to the branch, and given the size of the queues, you typically had a week to calm the herd and get people to put down their pitchforks. Today, money can be transferred in seconds from a mobile app or website.

That SVB had a decent balance sheet, had money, had no liquidity problems, was making its payments on time, was still growing, was still profitable - none of this mattered when the herd turned on it. Sure, they lent capital based on the value of wine, and had a business model designed for low interest rates - but that’s nothing more than a random footnote in the reality of modern banking weirdness. The key take here is - in this peculiar new world of social media-driven finance panic and bad amateur economics - global governments, and banking regulators, are rightly worried about mass mob contagion.

A bank is really just a trusted brand that does complex banky things. When that trust evaporates - even if it’s based on a rumour or a ‘hot take’ - failure, if it comes, is now near-instantaneous. This new ‘near-instantaneous failure’ problem is causing worries of wide-spread wipe outs. Bank runs are now no longer based on facts, poured-over financial statements or Matt Levine Bloomberg reports - but opinion, amateur economics and echo chambers.

One immediate effect from the SVB collapse is likely that, given the risk of contagion, the US Federal Bank is likely to hold off any further significant rate rises in the battle to contain inflation - as it seeks to desperately calm the markets. As Canadian mortgage rates are linked to the US bond market, this might lower the mortgage pressure for some.

But the other immediate effect is the collective shock and realization that any trusted bank brand can be toppled by a small group of people shouting at each other on social media - and that because modern finance and banking is so inter-connected - the after shocks from a baseless social panic can have huge implications for everyone.

As Gil Scott Heron once sang, “All we fear, is fear itself”. Welcome to the future of banking.

BTW - did you know you can reply to this email? We always read the responses and welcome feedback. Let us know what you like, what you don’t and what you’d like to see more of in the future!

If you find this report useful, why not share it with the other small business owners in your network? They’ll join hundreds of subscribers in accessing the best Small Business insights in Canada - for free!

THL Classifieds

We’re trialing something new - Classifieds!

The huuman layer is distributed to thousands of readers through Substack and the huumans.com partner ecosystem - including distribution to our thousands of social media followers.

What better way to talk about your business and connect your services with others?

Simply fill in this form to get things rolling! If you’re a huumans customer, you can get one FREE ad on us.

Top story this week☝️

More runs :(

SVB fell and was caught, but the runs continue. Despite President Biden appealing for calm, at the time of writing, market volatility was still severe, with most global banks taking a hit of between 4-8% on their share prices. Consumer confidence also started to drop in local banking, starting near-fatal runs on the numerous smaller regional banks in the US. Basically if you’re a bank which relies heavily on cash deposits, has struggled to keep that cash in current accounts (as people have moved it to high interest savings accounts) and identify as serving a ‘specific client’ (i.e startup businesses, real estate, etc) then you’re being watched very very carefully right now. First Republic sank by 62%, Western Alliance Bancorp sank by 47%, PacWest Bancorp sank by 21%. Customers Bancorp, Comerica and Zions Bancorp all saw 20% wiped off their values. Hell, even Credit Suisse is in a spiral. Neobanks (Wise, Monzo, Starling, Chime, Varo, Current) are also entering a dangerous world right now and keeping very very quiet - they’re cash reliant because they all serve Millennial / Gen Z consumers who have little RSP or Mortgage diversity - which is a client base who are VERY ONLINE with a proven habit of jumping on trends and who have little sympathy for capital markets. Link

News 🗞️

More plane pain

We’ve spoken before about the lack of diversity in the Canadian airline market causing unnecessary volatility, and how Westjet was able to, effectively, ‘cut off Europe’ on a whim for the entirety of 2023. As ever, only two big players dominate - Air Canada and Westjet - with Porter, Sunwing and Flair still hanging on, handling those ever-important niches. Oh, except Sunwing is now owned by Westjet. Anyway, this week Flair airlines (not currently owned by Westjet) saw part of its limited fleet seized at Toronto Pearson because of a ‘commercial dispute’ (whatever that means) with a New York-based hedge fund. We’ll probably never really get to the bottom of whatever this ‘dispute’ means, but it’s perhaps worrying that a ‘national’ airline can have its main assets seized without apparent notice at the gate. Given Canadian business is heavily reliant on airlines for both logistics and business travel, any visible instability in the Canadian airline industry is an immediate red flag. It also says something that the Canadian government has, today, ring fenced $75.9M CAD to tackle air passenger complaints. Link

US inflation remains stubbornly high

Consumer pricing is slowing in the US - prices increased 0.4 per cent last month, just below January's 0.5 per cent rise - but the worry is, that given the recent bank runs, the US Federal bank is now toothless when it comes to driving it down. Unlikely and possibly unable to raise interest rates thanks to the economic contagion stemming from the failure of SVB, the Fed is now hand-tied. Do they raise the rates to lower inflation, keeping on track for their target of 2%, but risk a devaluation of the bond market, triggering more bank defaults? Or do they keep the rates as they are and risk rising consumer inflation, increased credit and mortgage defaults and numerous Small Business failures? A seemingly impossible decision. Link

And finally…

Silicon Valley Bank fun. Link

Silicon Valley Bank serious. Link

Hackers build a racist open source AI chat bot - because of course they did. Link

Building ‘nice things’ for Millennials and Gen Z? Say hello to ‘mids’ Link

The Data Room 🤖

The Data Room provides some insight into Small Business data, and each month(ish) you’ll get a deeper dive in your inbox. Here’s this weeks quick insight:

Canadian contagion?

The US is struggling to contain a banking crisis - partially due to deregulation, partially due to bored people being on Twitter too much. But will this mess move North? We looked into the numbers so you don’t have to.

With all this news on Silicon Valley Bank, Canadians are trying to get a read on how it might affect financial activity up north. The six ‘Major Canadian Banks’ account for more than half of all lending in Canada, so small changes have the potential for a butterfly effect.

The government’s SMB data is slow to roll out, so we often have to rely on last year’s numbers. When we are still reeling from pandemic-driven financial outliers it can make it hard to get a read on where we are this month. So - what have the lending trends been for Canadian SMBs?

Let’s start with lending – in the first half of 2022, disbursements total $126.3B CAD, and of that, $15.7B CAD went specifically to small business. Since the first half of 2022, PayNet’s Canadian Small Business Lending Index’s latest data point is for December 2022, and it shows a decline of 11.6% in total lending. Now, 11.6% is a large decrease in any market, but it puts Canada more inline with numbers we were seeing pre-pandemic, and it’s likely reflective of the large amount of inflation we’re seeing.

Loan payment delinquencies have also been brought back down closer to pre-pandemic levels as well. During the peak of May-June 2020 we saw loan payment delinquencies of 2.18%, but as of December 2022 we’re looking at rates of closer to 0.81%. For reference, pre-pandemic delinquencies hovered around the 1% range.

Finally, let’s look at the bankruptcy numbers. The latest data shows 263 bankruptcies for January 2023, but these numbers have, let’s face it, been all over the place for the last few years. For example - between 2004 to 2023 Canada saw an average of 343 companies shutting down per month, and the lowest data point in that time period was in April of 2020 where only 108 businesses shut their doors. So while the latest rise in bankruptcies is certainly something to keep tabs on - when seen in a larger context - it’s nothing too out of the ordinary.

In short, we are in wildly turbulent times, and swings in SMB financials are…unpredictable. It’s not that ‘we the North’ are immune to disaster, it’s just when looking at the most important financial information out there, things are generally levelling out to pre-pandemic levels.

However, be warned - volatility is its own kind of fear-driven-hypebeast, and Small Business owners should be prepared short-term to suffer the swings of the market - either positive or negative - until they return to some form of normalcy in the mid-term.

The Balance Sheet 💬

The Balance Sheet provides Small Business opinion, voices and futures, and each month(ish) you’ll get a deeper dive in your inbox.

If you run a Small Business in Canada, the chances are your books (and therefore your taxes - and possibly payroll) touch one of three ‘cloud platforms’ - Xero, Quickbooks or Wave. So it makes sense to think about how these platforms operate, and how they intend to support Small Business owners (like yourself) moving forward.

Last Thursday we sat down for a chat with Faye Pang, the leader of Xero Canada, to talk about the challenges of making change happen, data responsibility, building trust - and how technology can rewire things for Small Business owners.

Market at-a-glance 📈

BOC Indicators (Link):

BOC Prime Rate: 6.70%

BOC Unemployment Rate: 5.0%

BOC CPI Inflation Rate: 5.9%

BOC $USD Exchange Rate (Link):

Low: 1.3717 CAD [0.7290 USD]

Average: 1.3766 CAD [0.7264 USD]

High: 1.3807 CAD [0.7243 USD]

Best GIC Rates (Link):

1-year GIC: 5.25%

3-year GIC: 4.90%

5-year GIC: 5.00%

Best 5Y Mortgage Rates (Link):

Variable: 5.45%

Fixed: 4.59%

Prime Rates (Link):

TD Bank: 6.70%

BMO: 6.70%

RBC: 6.70%

Scotiabank: 6.70%

CIBC: 6.70%

National Bank: 6.70%

CRA Canadian Pension Plan Rate: 5.95%

CRA Employment Insurance Rate: 1.63%

CRA Minimum Wage per Province: Link