The <SWING!> thing

January is already half-done and Q1 is definitely underway. Time to accept that all those things you put off pre-holidays aren’t going to get done, and read some great Small Business insights instead.

Hi there!

Not to keep banging on about it, but in our Nostradamus-like pre-holiday predictions we said that the constant swing between ‘There’s a recession coming!’ and ‘Nope, it’s all fine!’ would burn up a lot of business energy in 2023. We’re now merely two weeks into the new year and it’s already becoming exhausting.

Consumers expect recession! <SWING!> Job numbers are up! <SWING!> 18,000 jobs axed at Amazon! <SWING!> Business insolvency at pre-pandemic levels! <SWING!> Lack of stimulus will fracture the market recovery!

As you know, years of pandemic-induced depression and historic stimulus have caused unpredictable waves and we’re all still bobbing about on the surface. Will we see calmer waters by the end of the year? Hopefully, but we’ll all likely face long months of sea-sickness until then. Better grab that Gravol.

If you find this report useful, why not share it with the other small business owners in your network? They’ll join hundreds of subscribers in accessing the best Small Business insights in Canada - for free!

Top story this week☝️

US Inflation drops to 6.5%, Canadian inflation drops further to 6.3%

The big news this week is the inflation rate in the US decelerated to 6.5 per cent in December while the Canadian inflation rate dropped further to 6.3%. <SWING!> It’s still expected the US Federal Bank will raise interest rates again in February, but it’s now thought this may be limited to a quarter-point hike, with a hold at 5% for the rest of the year. The current inflation problem is a bit unique - both the US and Canada have seen unusually resilient consumer spending on services and an unusually tight labour market which have been keeping those every day prices high. US inflation impacts Canada in numerous ways - in fact the excess inflation Canada felt until recently was directly associated with the US markets and how the Bank of Canada was forced to raise rates inline with the Federal Bank. It’s a complex relationship - we wrote recently about how US and Canadian inflation is interlinked in The Data Room. Anyway, the good news is the tide is turning. Link

News 🗞️

Customers deciding on a frugal 2023?

While customer spending on services seems to be bucking the trend, customer spending on other things seems to be looking more restrained in the coming year. Most Canadians are looking to save money this year by cutting down on discretionary expenses according to recent reports - but like most new year resolutions, people do have a tendency to forget about them pretty quickly. Time will tell - January is traditionally when negative reports turn up in an effort to grab headlines during a go-slow news month (remember ‘Blue Monday’? Lol). Link

‘Time theft’ - the inevitable grim side of new work futures

This is an interesting story on several levels - a woman in B.C is ordered to repay her employer for work-from-home ‘time-theft’. On one level, it’s clear that there was a lack of trust in the organization. On another, it looks like the working culture was misaligned, and the employee was probably a bad fit. We’ll probably never know, but overall both sides of this case come out badly. We’ve spoken a lot about work futures, and how hybrid and remote work spaces need to push for meaningful cultural change - change inevitably hinged on mutual trust and ownership rather than tracking. This certainly won’t be the first ‘home-work-bad’ article to hit the news cycle this year (yawn), especially where the more interesting and useful topic of how culture intersects with trust is missing. Link

Some positive Small Business data news!

We love some positive, constructive Small Business news - so props to The Globe and Mail for talking about what is a good proactive data initiative from the Canadian Urban Institute. Helping Small Business owners access accurate market research data is exactly what local Chambers of Commerce and Business Institutes should be doing - rather than seeing who can shout about bad news the loudest. More doing in 2023, thankyouverymuch. Link

Banks to start charging fees to pay your taxes

RBC is joining Scotiabank in charging Small Business customers a $25 set up fee to use Can-Act - along with a $2 fee per transaction and a minimum $2 monthly fee - when they choose to pay their taxes from a business account. What is Can-Act? Well, RBC and Scotiabank have decided that Interac is not for them, brought in a third-party payment processor software from Can-Act Payment Services Inc, and decided it wise to get their commercial banking customers to pay for it. Industry bodies are naturally claiming this is ‘fee creep’ and say it shows how little the big banks care about helping Small Business owners. On the surface this certainly looks like nickel-and-diming. Our take? Always be on the look out for a banking partner who genuinely cares about your current business position - most business owners stick with the bank they use when they first start their business (typically the one they personally bank with) - and you could be missing out. Link

And finally…

Iconic, ever-enduring “this is fine” meme-dog-on-fire turns 10. Link

How to write a great tagline for your business. Link

Mullet-media (“business at the front - party at the back”) and the current state of our work-life balance. Link

How to kill a business in 3 months. Link

The Data Room 🤖

Each week, The Data Room provides some insight into Small Business data, and each month(ish) you’ll get a deeper dive in your inbox. Here’s this weeks insight:

Good news for Canada’s rural businesses

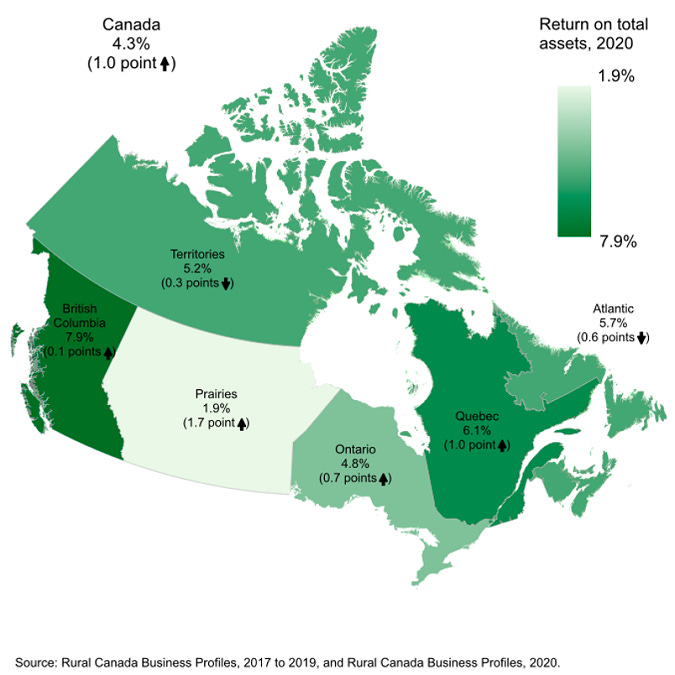

We sometimes forget Canada’s rural small businesses, focusing instead on their more visible metro-area siblings. But rural businesses make up over 15% of Canada’s total small and medium-sized business ecosystem, meaning they are something of a powerhouse - especially considering that they’re typically under-served, under-represented and under-appreciated.

This week, Statistics Canada released its 2020 data on rural small businesses, and the analysis is more positive than you would’ve guessed. From 2019 to 2020 Canada lost 4.1% of its small rural businesses (a small business is classified as having fewer than 100 employees), but medium sized rural businesses (100 to 500 employees) increased by almost 1%. When we contrast and compare with urban businesses, we saw a loss of 4.9% of small businesses and 3.2% of medium-sized businesses during the same period. Small businesses that were unincorporated fared the worst in both urban and rural settings, dropping by 12% across the board.

Surprisingly, rural small business revenue outpaced urban small businesses - seeing a 3.6% increase compared to 1.4% in urban areas. Even the return on total assets in rural areas increased by 1% (from 3.3% to 4.3%), while urban areas remained at a stable, unchanging 6.2%. Average annual revenue for rural small businesses in 2020 landed in at an impressive $462,000.

The moral of the story is - don’t forget about your local rural business community. They’re more powerful and sustainable than you’d think - even if they’re quiet about it.

The Balance Sheet 💬

This week we’re publishing the first proper edition of The Balance Sheet, a monthly(ish) deep dive from The huuman layer, focused on voices, opinions and the future of Small Business. This month we’re looking at one of the biggest news topics of the past few weeks - ChatGPT - and how it’s going to affect your business. Yes, we know - tech - but this is important. Here’s a quick preview:

ChatGPT, Machine Learning and the inevitable impact on Small Business

Deep Learning (DL), Machine Learning (ML), Large Language Models (LLMs) and Artificial Intelligence (AI) have been around for quite a long time. So long in fact that I've been avidly watching their steady progression for what seems like over a decade.

It’s hard not to admire the work that goes into building ever-new language databases aimed at trying to make sense of the mess that is daily human interactions. For a brief period in the late 2010’s it seemed everyone was working on, talking about or adopting ML in some way, shape or form. Since that early heyday, ML had, for me anyway, moved into the background; downgraded in my list-of-stuff to ‘something of interest', downgraded in the sense that the leaps and bounds that were made on a technical level were startling, sure, but not significant. Maybe it’s because ML was - is - everywhere, but it was hidden in everyday things - it had become so normal, so ubiquitous that it had become - dare I say it - mundane. You scan something and the text becomes magically editable? ML. Your iPhone Photos App recognizes faces? ML. You write an email and it tries to autocomplete it for you? ML. You make a Reel on Instagram or TikTok and it automatically captions what you say? ML. A transaction gets flagged as suspicious on your credit card? ML.

ML, it seemed, was in a hinterland of sorts, where things were progressing nicely and, sure, there were some really cool applications, but there there was no clear 'uncanny valley' moment, no ‘wow’ experience, no notable big leap which would result in a noticeable culture shift.

Last year, however, something did shift. The trajectory had changed. ML was back, baby - and this time it was significant in a way few imagined.

The Balance Sheet will be in your inbox on Thursday!

Some huumans updates ⚡️

If you’re a huumans customer, then you’ll know that we offer weekly data insights into your real-time business numbers, helping you to make better decisions. We’re now rolling out our data insights platform to more people, so keep an eye on your inbox over the next week!

Market at-a-glance 📈

BOC Indicators (Link):

BOC Prime Rate: 6.45%

BOC Unemployment Rate: 5.1%

BOC CPI Inflation Rate: 6.3%

BOC $USD Exchange Rate (Link):

Low: 1.3376 CAD [0.7476 USD]

Average: 1.3401 CAD [0.7462 USD]

High: 1.3425 CAD [0.7449 USD]

Best GIC Rates (Link):

1-year GIC: 5.25%

3-year GIC: 5.10%

5-year GIC: 5.20%

Best 5Y Mortgage Rates (Link):

Variable Closed: 5.200%

Variable Open: 6.600%

Fixed: 5.561%

Prime Rates (Link):

TD Bank: 6.45%

BMO: 6.45%

RBC: 6.45%

Scotiabank: 6.45%

CIBC: 6.45%

National Bank: 6.45%

CRA Canadian Pension Plan Rate: 5.95%

CRA Employment Insurance Rate: 1.63%

CRA Minimum Wage per Province: Link